QuoteMedia's Data Feed technology provides a highly flexible data delivery framework designed to best suit your needs.

Market data is securely delivered via multiple discrete channels, with each channel being individually selectable and configurable so that clients can choose individual markets or exchanges, and the specific data points they wish to receive.

QuoteMedia's Low Latency Data Feed Solutions are ideal for maximizing client-side efficiency while minimizing bandwidth costs. Each channel can be configured based on client needs.

Clients can choose TCP (Transmission Control Protocol) connections, or UDP (User Datagram Protocol) messaging. The data can be streamed over dedicated lines or via the Internet.

Clients can choose to receive compressed or uncompressed data. Compression can reduce bandwidth requirements by a factor of up to 6:1 during peak loads. QuoteMedia’s Data Feed uses proprietary compression systems which decompress via standard ZLIB (gzip/deflate) decompression algorithms, thus allowing for easy client side decompression. Furthermore, these high-speed compression algorithms add negligible latency to the feed.

Clients can choose binary data messages or String Readable data messages. Binary data messages provide the fastest performance and lowest latency. Alternatively, string readable data reduces client time-to-market in some cases by simplifying implementation, testing, and maintenance.

Clients can elect to receive a complete feed for a given exchange, which includes every tick. Alternatively, clients can receive moderated feeds with aggregated updates. QuoteMedia’s proprietary aggregation algorithms can lower bandwidth expenses, reduce data volumes, and improve system efficiency for clients who do not require a complete tick-by-tick feed.

QuoteMedia’s Data Feed provides data in real-time or delayed. If delayed data is desired, pre-delayed data channels can be used to ensure proper compliance with Exchange licensing requirements.

QuoteMedia’s Data feeds allow clients to stream entire datasets on per exchange/channel basis, or to selectively subscribe to specific sets of symbols and message types - level 1 quotes vs trades vs price data vs orders for example – to substantially reduce bandwidth and processing overhead when an entire marketplace is not required.

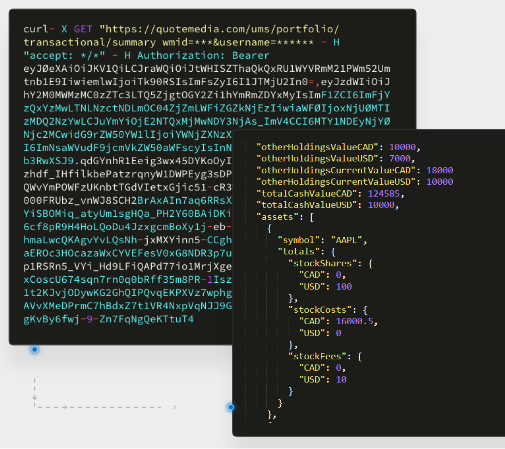

QuoteMedia provides client side libraries and sample code in Java, .Net, and Javascript that ease client implementation and reduce development time and complexity.

We would love to discuss QuoteMedia Data Solutions with you. If you have any questions or you would like a demo, please reach out to us. We look forward to meeting you.